See? 28+ Facts On Break Even Ebit Formula They Forgot to Let You in!

Break Even Ebit Formula | How to find break even ebit? The biggest mistake people make, however, says avery, is not even running a breakeven analysis. It also helps to find out whether the company is financially sound and can keep. Break even point in accounting refers to the point or activity level at which volume of sales or revenue exactly equals total expenses. Please provide required elements of this formula to calculate ebit break even.

Even if the numbers are tough to get right in advance, avery says, it's simply good marketing management to. Before we even put all the facts together, you need to draw a clear line between fixed and variable costs. I have an equation where i need to set the eps equations equal to each other then solve The following is the further explanation of this concept We'll look into detail how both expenses are distinct from each other just shortly.

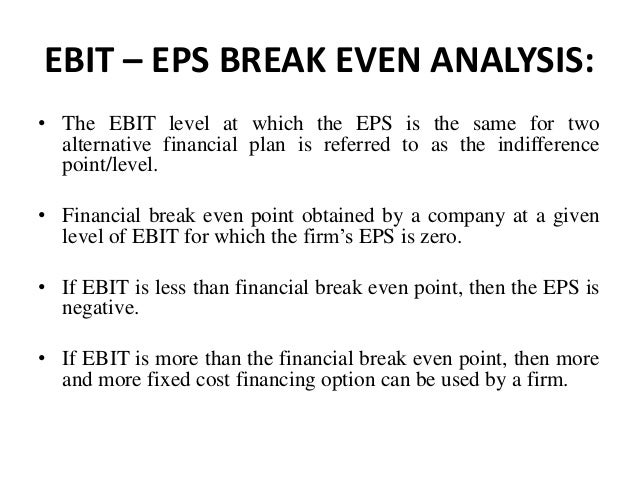

Please provide required elements of this formula to calculate ebit break even. At this level of ebit, a firm can be indifferent about its capital. In the above formula, the weighted. Break even ebit can be calculated with the below written formula when there is no preferred stock. Even if the numbers are tough to get right in advance, avery says, it's simply good marketing management to. This site might help you. How to find break even ebit? We'll look into detail how both expenses are distinct from each other just shortly. Now apply the classic formula for calculating breakeven output: This information is used in computing weighted average selling price and weighted average variable expenses. When will it start making a profit? At break even point total sales are equal to total cost (variable + fixed). One can express the relationship between ebit and net income in the following way:

How to find break even ebit? The following is the formula to calculate the earnings per share (eps). If the information is available, it is always quicker and easier to use this formula rather than use a table or draw a chart. This site might help you. The formula will tell the manager how many units will result in $10 million in profit.

Read here for a detailed understanding. It indicates the profitability and strength of a business. We'll look into detail how both expenses are distinct from each other just shortly. This information is used in computing weighted average selling price and weighted average variable expenses. Ebit is sometimes referred to as operating earnings or operating profit. The following is the formula to calculate the earnings per share (eps). Ebit calculator calculates earnings before interest and taxes of a company. How to find break even ebit? Following is the ebit formula on how to calculate ebit. Break even point in accounting refers to the point or activity level at which volume of sales or revenue exactly equals total expenses. If the firm can sell at production levels above this point, it will be making a profit. If the information is available, it is always quicker and easier to use this formula rather than use a table or draw a chart. Not sure what the next step is.

This site might help you. This guide will refers to the point in which total cost and total. Also, the breakeven point acts as an essential level for a business to attain before it can make a profit. The biggest mistake people make, however, says avery, is not even running a breakeven analysis. Please provide required elements of this formula to calculate ebit break even.

Now apply the classic formula for calculating breakeven output: If the firm can sell at production levels above this point, it will be making a profit. Note that in this formula, fixed costs are stated as a total of all overhead for the firm, whereas price and variable costs are stated as per unit costs— the price for. If the information is available, it is always quicker and easier to use this formula rather than use a table or draw a chart. It indicates the profitability and strength of a business. If a firm cannot manage sales to cover variable as well as fixed costs it will have to bear losses. At break even point total sales are equal to total cost (variable + fixed). Before we even put all the facts together, you need to draw a clear line between fixed and variable costs. Break even ebit can be calculated with the below written formula when there is no preferred stock. This guide will refers to the point in which total cost and total. The ebit formula is shown below to show you how to calculate ebit. Please can someone spell this out step by step. Also, the breakeven point acts as an essential level for a business to attain before it can make a profit.

Break Even Ebit Formula: To get a better sense of what this all means, let's take a more detailed look at the formula components.

Source: Break Even Ebit Formula

0 Response to "See? 28+ Facts On Break Even Ebit Formula They Forgot to Let You in!"

Post a Comment